e-Invoicing is changing the way we do business here and around the world, but how can it benefit your business? In this article, we explain how e-Invoicing will benefit your business through:

- Cost savings: save up to 70% on invoice processing costs

- Fewer errors: automation instead of manual data entry

- Security and reliability: encrypted invoice data is sent directly from business to business

In 2020, Australia and New Zealand joined Singapore and Europe to adopt the Peppol e-Invoice standard. Peppol is the new chapter of business process automation and e-Documents. It enables you to send an e-Invoice directly to the receiver’s accounts payable software over a secure network. This in turn, enables automation for processing, recording and even paying invoices – practically eliminating human error. For instance, this automation can save a business 70% on their invoice processing – forever.

What is e-Invoicing and the Peppol network?

Simply put, e-Invoicing (or electronic invoicing) is the automated direct exchange of invoice data between a buyer and supplier’s accounting system.

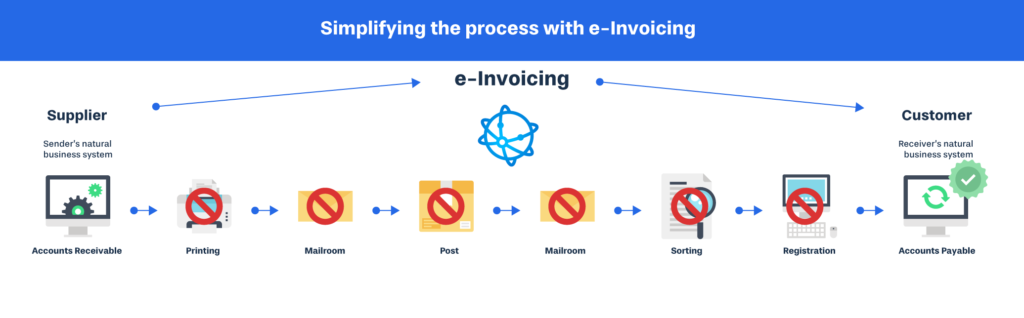

An e-Invoice is not an emailed PDF document. Understanding the difference is key. Traditional PDF invoices require your accounts payable officer to manually copy data across into your company’s systems. e-Invoices on the other hand, are configured to automate the data transfer process directly from system to system.

A PDF invoice, whether emailed or sent via the post, requires your team to manually enter the data into your accounting system. Traditional post and email are both risky methods of transit, because they are publicly accessible addresses.

Peppol 101 – the basics you need to know

The Australian Taxation Office and other key government departments in Australia and New Zealand have integrated into the Peppol network and use it as the country’s e-Procurement standard.

Key points:

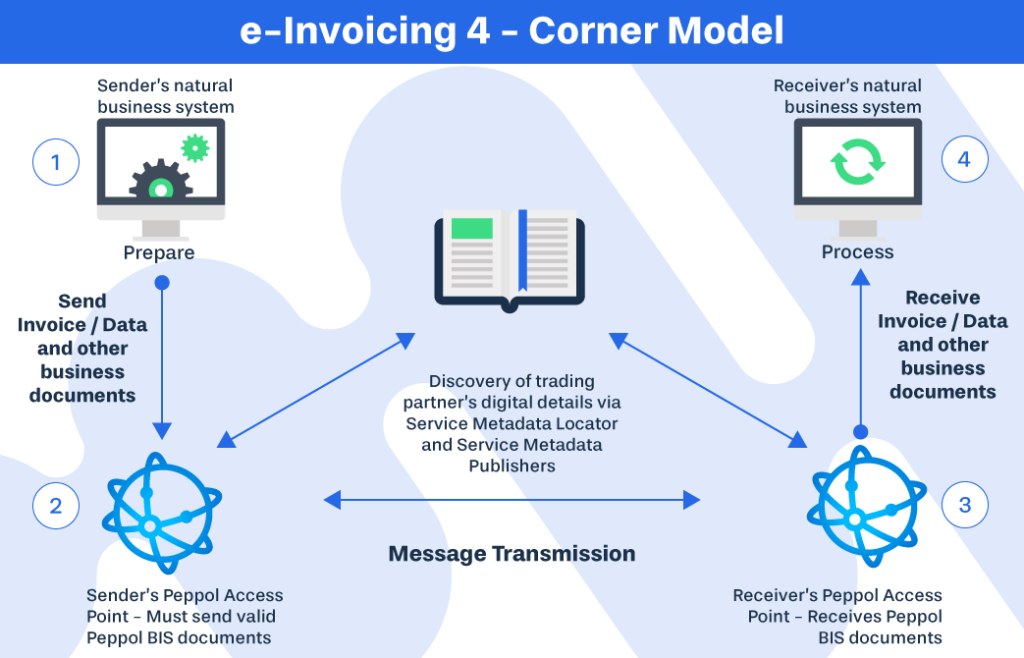

- Peppol is a set of rules for formatting e-Invoice documents: this is what allows for standardisation across international borders.

- Peppol is an infrastructure: this is how it sends e-Invoices between “access points” which know how to forward documents to businesses or government departments.

By using Peppol, e-Invoices are secure, compliant and their processing can be automated in all 32 participating countries, including all of the EU, the US, Singapore – as well as Australia and New Zealand. e-Invoices are compliant with the local invoice regulations and the A-NZ invoice specification.

e-Invoices Are 70% cheaper to process

Traditional invoice processing is a money pit. Every accounts payable officer knows this, and yet the majority of businesses continue to waste tens or hundreds of thousands of dollars, year after year. In fact, the Australian Taxation Office found manually-processing an invoice costs $30 on average. In contrast, a fully-automated e-Invoice costs only $9.18.

According to Concur Invoice data, a typical small-medium business will send 450 invoices in a busy month. Connecting the dots, this same business would spend $162,000 just on processing invoices each year!

If you’re scratching your head, thinking $30 vs. $162,000 a year? Well, it goes to wages. The average accounts payable officer can process five manual invoices per hour (12 minutes per invoice). Still assuming 450 invoices, that’s 90 hours a month on data entry tasks or close to 60% of a full-time employee’s month. The 90 hour average is likely the best-case scenario. However, accounts payable officers are human, and humans make mistakes. Research showed that 20% of traditional invoices are sent to the wrong person or address and around 30% contain the wrong information.

On average, each paper invoice error costs a company $53.50 to rectify.

Embracing e-Invoices will improve your bottom line.

Your business will eliminate:

- Manual communication delays to reply to emails or even worse… snail mail

- Time spent chasing up a missing invoice details like ABN’s, or a correct account number

- Repeatedly logging into financial software to match purchase orders or process edits

- Transaction holds with the bank resulting from incorrect numbers or details

- Delays with gatekeepers.

You’re likely losing one FTE on data-entry tasks alone when they could be utilised elsewhere within your business. With e-Invoices accounts payable officers can process Peppol e-Invoices in under two minutes. As an example, an e-Invoice’s data is electronically verified and seamlessly transferred between financial systems, within the Peppol network. It’s faster and more accurate than paying a qualified employee to copy lines in PDFs.

Peppol users are protected from invoice fraud: the network is secure, unlike emails

Email addresses aren’t authenticated even when they look like they are. Criminals can (and do) impersonate suppliers and perform all manner of scams, including convincing accounts teams to change on-file bank details. In 2019, The ACCC said,

“The most financially damaging business email compromise scams involved invoices between businesses, suppliers or individuals being intercepted and amended with fraudulent banking details”.

The ACCC, 2019

Accredited access points minimise invoice-fraud with Peppol

The Peppol network only permits accredited access points to send e-Invoices. In Australia, the only authority that can authenticate access points is the Australian Taxation Office. Their role is to regulate local access points and BIS document compliance. Every country in the Peppol network has a similar arrangement, with only one trusted authority permitted to regulate the system locally. This level of security and governance reduces invoice fraud drastically.

Business connections to Peppol

To connect to Peppol, suppliers and businesses undergo a Know-Your-Customer process and register with an access point. The Peppol network connects directly to its own address directory linking to key business identifiers. The Australian network, for instance, uses the Australian Business Number (ABN) to determine each invoices destination. These are important steps that will not only reduce fraud but will improve your business’ efficiency.

OZEDI – Accredited Australian Access Point

Since 1981, our founders have been innovating in Australia’s accounting and payroll industry, and to this day we continue to focus on being Australasia’s leading digital delivery experts. The Australian Government and more than 100 software providers trust OZEDI as their digital solutions provider.

Connect your business to OZEDI’s data hub to securely automate your e-Invoice exchange and processing. Whatever your business, if you have an ABN or an NZBN, you’re ready to automate your invoice processing and save up to 70% of accounts payable costs on every invoice. e-Invoicing allows you to utilise staff on more essential business tasks, receive payments faster, reduce your processing costs and improve valuable relationships with your suppliers.

Interested in learning more? Check out www.ozedi.com.au/e-Invoicing or visit www.einvoicing.com to look up your accounting software and begin your e-Invoicing journey.

Or you can download our Guide to e-Invoicing white paper below